Litecoin, often denoted as LTC, stands as one of the pioneering cryptocurrencies that entered the digital finance world after Bitcoin. Designed to address some of Bitcoin’s perceived challenges, it offers faster transaction processing speeds and presents itself as a more transaction-friendly digital currency. Functioning on a decentralized network, it enables peer-to-peer transactions without the need for a central authority.

Historical Context in Relation to Bitcoin

The realm of cryptocurrencies was birthed by the emergence of Bitcoin in 2009, a groundbreaking solution introduced by an anonymous figure or group known as Satoshi Nakamoto. Bitcoin introduced the world to blockchain technology and the concept of decentralized digital currencies. However, as innovative as Bitcoin was, its growing adoption revealed certain limitations, especially in terms of scalability and transaction speeds.

Enter Litecoin in 2011, conceived and developed by Charlie Lee, a former Google engineer. While Litecoin’s foundational principles are derived from Bitcoin – to the extent it is often termed as the “silver to Bitcoin’s gold” – it introduced modifications in its protocol to enhance transaction speeds and improve scalability. By altering the hashing algorithm and reducing the block generation time, Litecoin aimed to cater to everyday transactions, setting itself apart from Bitcoin’s evolving stature as a ‘store of value.’

Origins of Litecoin

Creator: Charlie Lee and His Background

Charlie Lee is the genius behind Litecoin’s creation. Before his foray into the world of cryptocurrencies, Lee honed his skills as a software engineer at tech giants like Google, where he contributed to projects including YouTube and Google Play. Lee’s academic background boasts degrees from MIT, reflecting both his competence and passion for technology. Beyond Litecoin, Lee is recognized for his active participation in crypto-discussions, engaging with the community, and offering his perspectives on various digital currency issues.

The Birth of Altcoins

The success of Bitcoin, the first-ever cryptocurrency, naturally paved the way for the emergence of other digital currencies – commonly termed as altcoins (alternative coins). As Bitcoin continued to gain traction, its limitations became evident, thereby creating opportunities for other digital currencies to offer solutions to these challenges. Altcoins were not merely about creating another Bitcoin; instead, they aimed at diversifying the use-cases, functionality, and even the underlying technology of cryptocurrencies.

The Motivation Behind Litecoin’s Creation

Charlie Lee’s vision for Litecoin wasn’t just about crafting another cryptocurrency; it was about refining the concept. Lee was a witness to Bitcoin’s scalability issues and its subsequent challenges, particularly slow transaction processing speeds and concerns regarding mining centralization. Given his technological background, he saw an opportunity to enhance the existing system.

Litecoin was thus born out of a desire to:

- Speed Up Transactions: While Bitcoin blocks take approximately 10 minutes to generate, Litecoin reduced this time to 2.5 minutes, making transactions faster and more suitable for everyday use.

- Tackle Mining Monopolies: By introducing the Scrypt hashing algorithm, Lee aimed to democratize the mining process, potentially allowing for a broader user base to participate in mining, as opposed to just those with specialized hardware.

- Offer a More Viable Option for Daily Transactions: Bitcoin’s stature as a store of value meant that it was less efficient for day-to-day transactions. Litecoin was envisioned to fill this gap, promoting itself as the go-to digital currency for regular transactions.

Technical Aspects

Understanding the intricacies of Litecoin requires diving deep into its technical components. From how it differentiates itself from Bitcoin to the mechanisms driving its mining, let’s unravel the complexity that underpins this popular altcoin.

Litecoin vs. Bitcoin

Litecoin vs Bitcoin

The comparison between Litecoin and Bitcoin is crucial to distinguish the advancements made by the former. While both cryptocurrencies share many similarities due to Litecoin being a fork of Bitcoin, key differences set them apart:

- Differences in Hashing Algorithms: Scrypt vs. SHA-256

- SHA-256: This is the algorithm that powers Bitcoin. It’s computationally intensive, requiring powerful, specialized hardware known as ASICs (Application-Specific Integrated Circuits) for efficient mining.

- Scrypt: Used by Litecoin, Scrypt was designed to be more memory-intensive, which initially made it resistant to ASIC-mining, leveling the playing field for individual miners. However, over time, Scrypt-specific ASICs have been developed, albeit they’re less dominant than in the Bitcoin landscape.

- Transaction Speeds and Block Generation Times

- Bitcoin’s block time stands at approximately 10 minutes, which means it can take that long (or even longer, depending on the need for confirmations) for a transaction to be processed.

- In contrast, Litecoin’s block generation time is roughly 2.5 minutes, allowing for faster transaction confirmations and making it more suitable for frequent, smaller transactions.

- Total Supply: 84 million vs. 21 million

- Bitcoin’s capped supply is set at 21 million coins, a deflationary feature to combat the inflationary tendencies of traditional fiat currencies.

- Litecoin, on the other hand, has a maximum supply of 84 million, exactly four times the number of Bitcoin. This ensures a larger circulation, potentially leading to smaller denominations for everyday transactions.

Mining Litecoin

Mining plays an integral role in the cryptocurrency ecosystem. It’s the process by which new coins are introduced into circulation and how transactions are confirmed:

- Explanation of Proof of Work in Litecoin

- Just like Bitcoin, Litecoin employs a Proof of Work (PoW) consensus mechanism. This requires miners to solve complex mathematical problems to validate transactions. The first miner to solve the problem gets to add a new block to the blockchain and is rewarded with Litecoin.

- Mining Rewards and the Concept of Halving

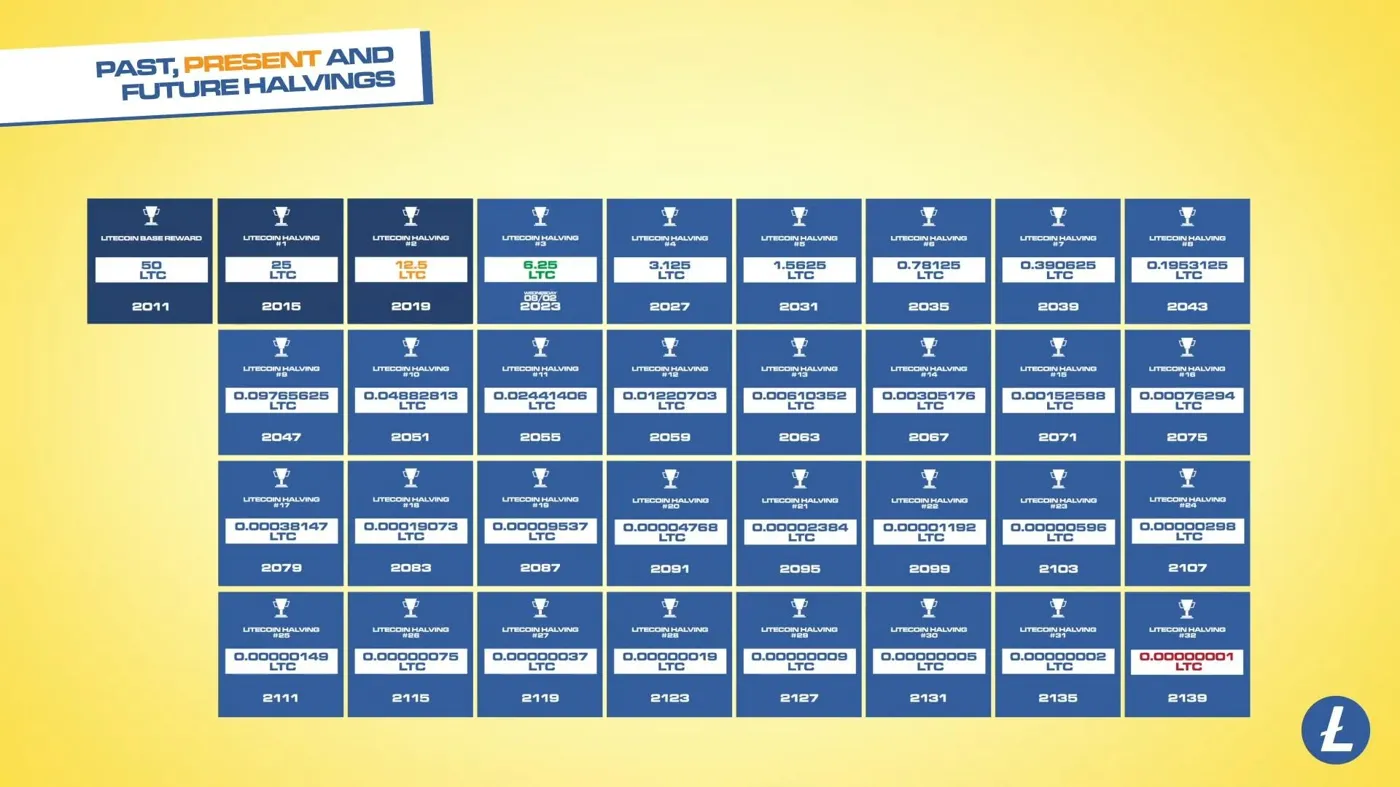

- When Litecoin was first launched, miners were rewarded with 50 LTC for every block mined. However, to control inflation and ensure longevity, this reward is halved every 840,000 blocks. As of the last update, the reward stood at 6.25 LTC, with the next halving anticipated in 2027.

Litecoin Halving

- When Litecoin was first launched, miners were rewarded with 50 LTC for every block mined. However, to control inflation and ensure longevity, this reward is halved every 840,000 blocks. As of the last update, the reward stood at 6.25 LTC, with the next halving anticipated in 2027.

- Requirements and Challenges of Litecoin Mining

- Mining requires powerful computational resources. While initially, the Scrypt algorithm allowed for more democratized mining using GPUs, the advent of Scrypt ASICs has somewhat centralized the process.

- High energy consumption, increasing difficulty levels, and competition from large mining pools are challenges faced by individual miners.

Litecoin’s Blockchain and Security

The blockchain is the backbone of any cryptocurrency, offering both transparency and security:

- Understanding the Blockchain

- Litecoin’s blockchain is a decentralized ledger that records all transactions across the network. Every time a transaction occurs, it’s added to a “block”. Once this block is filled with transactions, it’s added to a continuous chain in a linear, chronological order.

- How Transactions are Verified and Added

- Miners play the role of transaction validators. By solving the mathematical problems (via PoW), they verify the legitimacy of transactions. Once verified, these transactions are added to the next available block on the blockchain.

- Security Measures and Immutability

- Once a block is added to the blockchain, it’s practically immutable, meaning it can’t be altered without altering all subsequent blocks, which requires the consensus of the majority of the network.

- This immutability, combined with cryptographic techniques, makes the Litecoin blockchain secure against fraudulent activities and hacks. The decentralized nature of the network also ensures there’s no single point of failure.

Economic Aspects

Litecoin, often touted as the “silver to Bitcoin’s gold”, isn’t just technically distinct, but also demonstrates unique economic characteristics. Diving into its economic facets can offer insights into its value proposition and sustainability in the ever-evolving digital currency market.

Litecoin’s Market Presence

The market presence of a cryptocurrency can often be a reflection of its adoption, trustworthiness, and potential future trajectory:

- Trading Volume and Liquidity

- Trading volume is indicative of how frequently Litecoin is bought or sold in cryptocurrency exchanges. High trading volumes can be a sign of active interest in LTC and its utility in the market.

- Liquidity refers to how easily Litecoin can be converted into cash or other cryptocurrencies without affecting its price. A higher liquidity often means that the market is healthier and that there’s a lower chance of sudden price fluctuations.

- Merchant Adoption and Real-World Use Cases

- Beyond speculative trading, the real value of a cryptocurrency is seen in its real-world adoption. Numerous merchants, both online and offline, have begun accepting Litecoin as a payment method, ranging from e-commerce platforms to local cafes.

- Real-world use cases extend to remittances, online purchases, and even charitable donations. Its faster transaction times make it an attractive option for merchants who demand quicker settlement times.

Transaction Costs

Transaction fees are a pivotal factor for many, from individual users to merchants, when deciding to use or adopt a cryptocurrency:

- Comparing Transaction Fees with Other Major Cryptocurrencies

- As of the last known data, Litecoin’s transaction fees averaged around 0.06%, making it considerably cheaper than Bitcoin, which was around 3.92% on average. However, these fees fluctuate based on network congestion and other factors.

- When compared to other major cryptocurrencies, Litecoin often offers a competitive edge, balancing both speed and cost-effectiveness. For example, while certain newer cryptocurrencies might boast even lower fees, they might not have the same level of security, adoption, or decentralization as Litecoin.

Supply Control: Halving

One of the significant economic mechanisms that ensures Litecoin’s scarcity and potential value appreciation over time is halving:

- Purpose and Impact on Supply and Value

- The concept of halving is integrated to control inflation and to introduce a deflationary mechanism. By reducing the miners’ rewards in half at regular intervals, the introduction of new coins into the system slows down, thereby potentially creating upward pressure on the price due to reduced supply.

- Historically, halvings have been associated with price surges, though other market dynamics also play a role. The anticipation of reduced supply often drives speculative demand.

- Historical Halvings and Predictions for Future Ones

- Litecoin has already undergone several halvings. The initial reward of 50 LTC decreased to 25 LTC in the first halving, then to 12.5 LTC in the subsequent one and so on.

- The next halving is expected in 2027, wherein the reward will further decrease to 3.125 LTC. Predicting the exact impact of this on Litecoin’s value is challenging due to myriad market factors, but historical patterns suggest a potential increase in interest and price around halving events.

Understanding the economic aspects of Litecoin is crucial for potential investors and adopters. It offers a balanced view, emphasizing not just the technical prowess but also the tangible value and potential growth of Litecoin in the market.

Advantages and Disadvantages

When evaluating any cryptocurrency, it’s essential to consider both its strengths and limitations. As one of the earliest altcoins, Litecoin brought innovations that addressed some of Bitcoin’s perceived shortcomings. But like any technology, it also faces challenges, both past and emerging.

Pros of Litecoin

Litecoin’s robust market presence can be attributed to a combination of features that have differentiated it from other cryptocurrencies:

- Speed, Low Fees, and Adaptability

- Speed: Litecoin has significantly faster transaction confirmation times than Bitcoin. Where Bitcoin transactions take about 10 minutes on average for block confirmation, Litecoin averages 2.5 minutes. This speed makes it more suitable for time-sensitive transactions.

- Low Fees: As mentioned earlier, Litecoin’s transaction fees are considerably lower, making it a cost-effective choice for transfers and payments. Such low fees have the potential to drive adoption among users who make frequent or high-volume transactions.

- Adaptability: Litecoin has a history of implementing and testing new cryptocurrency features before they’re adopted by Bitcoin, such as Segregated Witness and the Lightning Network.

- Merchant Acceptance and Integration

- With its speed and lower transaction fees, many merchants have recognized Litecoin’s potential. It’s increasingly being accepted by various businesses, both large and small.

- Integration into payment platforms and gateways means users can spend Litecoin with ease, bridging the gap between cryptocurrency and real-world utility.

Cons of Litecoin

Despite its advantages, Litecoin also faces challenges that potential investors and users should be aware of:

- Controversies: Charles Lee’s Divestment

- In 2017, Charlie Lee, the founder of Litecoin, sold and donated all of his Litecoin holdings. While Lee cited avoiding conflicts of interest as his reason, the move raised eyebrows in the crypto community.

- Some critics argued it signaled a lack of faith in the project’s future, while others respected his decision to prevent perceived manipulations. Regardless, this divestment remains a topic of debate and has influenced investor sentiment.

- Competition: How Layer-2 Solutions and Other Cryptos Challenge Litecoin’s Unique Selling Points

- Layer-2 Solutions: Innovations like the Lightning Network on Bitcoin are designed to speed up transaction times significantly and reduce fees. These solutions can potentially undermine Litecoin’s faster transaction USP.

- Emerging Cryptos with Faster TPS: Newer cryptocurrencies like EOS, XRP, and Cardano have been developed with far higher transaction per second (TPS) capacities. This stiff competition challenges Litecoin’s position as a fast, low-fee alternative.

- Broader Altcoin Market: The vast number of altcoins now available means Litecoin competes for attention, adoption, and investment more than ever before. Each new coin or token presents its unique features, value propositions, and technological innovations.

Litecoin’s journey through the cryptocurrency landscape has been marked by both pioneering innovations and challenges. For potential adopters or investors, understanding its pros and cons provides a balanced view, essential for informed decision-making in the dynamic world of digital currencies.

Litecoin in the Broader Cryptocurrency Ecosystem

In the complex and rapidly evolving world of cryptocurrencies, every digital coin or token seeks to carve out its niche. Litecoin, given its foundational role as one of the first altcoins, has not only made a lasting impact but also continuously adapted to the ever-changing crypto landscape. Here’s a closer look at its position, collaborations, and influence within the broader ecosystem.

Position among other altcoins

- Veteran Status: Litecoin, often dubbed the “silver to Bitcoin’s gold,” has cemented its place as one of the foundational pillars of the altcoin world. Being one of the first altcoins, it commands respect, trust, and has a proven track record in the crypto community.

- Market Cap and Liquidity: Consistently maintaining a top-ranking position in terms of market capitalization, Litecoin has proven its resilience through various market cycles. Its liquidity is also commendable, with LTC being readily available for trade on virtually all major cryptocurrency exchanges.

- Recognition and Branding: Thanks to its history and consistent presence, even people relatively new to the crypto space often recognize the name and brand of Litecoin. This familiarity gives it a competitive edge in an oversaturated market.

Collaboration and integrations in the crypto world

- Payment Gateways: Litecoin’s focus on being a medium of exchange has led to partnerships with various payment processors. Platforms like BitPay and CryptoPay have integrated Litecoin, making it easier for merchants to accept LTC as a mode of payment.

- Atomic Swaps: Litecoin was one of the first to test out atomic swaps, specifically with Decred and Vertcoin. This technology allows for cross-chain exchanges without centralized parties, further cementing Litecoin’s adaptability and willingness to collaborate.

- Lightning Network: Though initially a Bitcoin project, Litecoin’s adaptability saw its early implementation and testing of the Lightning Network. This not only showcased Litecoin’s collaborative spirit but also its role as a testing ground for new crypto technologies.

How it has influenced or been influenced by other projects

- Trailblazing for Altcoins: Litecoin’s modifications to the Bitcoin protocol (like its Scrypt hashing algorithm and faster block times) have set the precedent for other altcoins. Many newer projects have taken inspiration from Litecoin’s tweaks to the original Bitcoin code.

- Mutual Influence with Bitcoin: Given that Litecoin was a fork of Bitcoin, there’s been a kind of symbiotic relationship between the two. Litecoin often serves as a “testnet” for Bitcoin, trying out new features before they go live on Bitcoin. Conversely, Litecoin has also integrated innovations developed for Bitcoin.

- Adoption Strategies: Litecoin’s efforts in marketing, partnerships, and community building have been emulated by newer projects seeking similar success. On the flip side, Litecoin continues to adapt and evolve, borrowing strategies and tech from emerging coins and tokens.

Litecoin’s legacy in the cryptocurrency ecosystem is undeniable. From its early days to its current position, it’s a testament to adaptability, innovation, and the power of a committed community. As the crypto space evolves, Litecoin stands as a beacon of both historical significance and future potential.

Future Outlook

Litecoin, as one of the pioneering cryptocurrencies, has seen its fair share of market cycles, technological developments, and changing narratives in the broader crypto ecosystem. Its longevity speaks to its adaptability and the dedication of its community. As we look ahead, there’s a mixture of optimism, innovation, and acknowledgment of the challenges that lie before Litecoin. Let’s delve deeper into what the future might hold for this veteran crypto.

Predictions based on current trends

- Adoption Growth: Given the increasing acceptance of cryptocurrencies in mainstream finance and commerce, Litecoin, with its established reputation, is poised to see further adoption, both among individual users and merchants. Its fast transaction times and lower fees could make it a preferred choice for everyday transactions.

- Stable Value Proposition: Historically, Litecoin has showcased less volatility compared to some other cryptocurrencies, possibly due to its mature market and established user base. This could make it a more appealing choice for those looking for stability in the tumultuous crypto world.

- Interoperability: With the growing emphasis on cross-chain collaborations and DeFi, Litecoin may further integrate with other blockchains, paving the way for enhanced liquidity and new use cases.

Technological advancements and updates in the pipeline

- MimbleWimble Implementation: One of the most anticipated updates for Litecoin is the integration of MimbleWimble via Extension Blocks. This would bring enhanced privacy and scalability to Litecoin transactions, setting it apart from many competitors.

- Improved Smart Contract Capability: As the broader crypto ecosystem shifts towards DeFi and dApps, there’s potential for Litecoin to upgrade its smart contract functionalities, possibly making it a player in the burgeoning DeFi space.

- Continued Emphasis on Speed and Efficiency: The Litecoin development team remains committed to ensuring that the network remains one of the fastest and most efficient in the crypto space. Future updates may focus on further reducing transaction times and fees.

Challenges and potential setbacks

- Increased Competition: As newer cryptocurrencies emerge with advanced features and niche value propositions, Litecoin will face stiff competition. It will need continuous innovation to maintain its relevance.

- Regulatory Uncertainties: Like all cryptocurrencies, Litecoin may face regulatory challenges that could impact its adoption rate and market value. Staying adaptable and compliant will be crucial.

- Network Security: As proof-of-work cryptocurrencies mature and block rewards decrease, there’s the challenge of maintaining network security. Ensuring that mining remains profitable and resistant to centralization will be crucial for Litecoin’s long-term viability.

While challenges lie ahead, the future looks promising for Litecoin. Its legacy, combined with the ongoing commitment to innovation and a robust community, positions it well in the ever-evolving cryptocurrency landscape. As with any investment, potential Litecoin enthusiasts should stay informed, consider the broader market context, and be ready for the exciting twists and turns of the crypto journey.

Investment Perspective

Litecoin, often referred to as the “silver to Bitcoin’s gold”, has been a mainstay in the cryptocurrency community since its inception in 2011. Its historical resilience, coupled with its adaptability, makes it an interesting asset from an investment perspective. As we delve into Litecoin’s investment scenario, it’s essential to consider the past, the expert analyses, and the inherent risks involved.

Historical Performance

- Consistent Top Performer: Since its launch, Litecoin has consistently maintained a position within the top cryptocurrencies by market capitalization. This longevity and consistency reflect its perceived value and trust within the crypto community.

- Market Cycles: Like most cryptocurrencies, Litecoin has seen its share of bull and bear cycles. For instance, its price surge in late 2017 was followed by a prolonged market cooldown in 2018. However, historically, Litecoin has showcased a knack for strong recoveries after downturns.

- Adaptability: Litecoin’s price has often been influenced by its technological advancements and adaptability. Key updates and integrations have generally led to positive market reception.

Expert Opinions and Advice

- Diverse Opinions: As with most cryptocurrencies, expert opinions on Litecoin’s investment potential vary. While some praise its technological strengths and see it as undervalued, others believe newer cryptocurrencies with advanced features may overshadow it.

- Long-Term Perspective: Many crypto analysts recommend a long-term perspective for Litecoin, given its historical ability to rebound and adapt. They believe Litecoin’s true value lies in its longevity and steady development.

- Potential in Diversification: Financial experts often tout the importance of diversification in investment portfolios. Given Litecoin’s unique attributes and its distinction from Bitcoin, it might serve as a diversification tool within a broader cryptocurrency investment strategy.

Risk Assessment for Potential Investors

- Market Volatility: Like all cryptocurrencies, Litecoin is subject to market volatility. Prices can experience significant fluctuations within short time frames. Potential investors should be prepared for this inherent volatility and consider it in their risk tolerance.

- Technological Risks: While Litecoin has a proven track record, it’s still a technology-driven asset. Any potential security vulnerabilities or major network issues could impact its value.

- Regulatory Landscape: The evolving regulatory landscape for cryptocurrencies remains a wildcard. Future regulations could influence Litecoin’s adoption and usability, impacting its value.

- Research is Key: Before diving into any investment, thorough research is essential. Potential investors should stay updated on Litecoin’s development, market trends, and global economic factors that might influence the crypto space.

From an investment perspective, Litecoin presents a blend of rich history, technological promise, and the typical risks associated with cryptocurrencies. It offers potential rewards for those who believe in its value proposition and are prepared for the roller-coaster world of crypto investments. As always, potential investors should consult with financial advisors, engage in comprehensive research, and approach the crypto market with both enthusiasm and caution.

Conclusion

Litecoin stands as a testament to the evolutionary spirit within the cryptocurrency ecosystem. Conceived as an enhancement to the original Bitcoin protocol, it has managed not only to coexist with its predecessor but also to carve out a distinctive niche for itself. With faster transaction speeds, unique technological underpinnings, and a vast user base, it symbolizes the immense possibilities inherent in the world of decentralized finance.

Throughout this exploration, we’ve witnessed Litecoin’s origins as an attempt to address perceived shortcomings in Bitcoin, its technical strengths that set it apart, its position in the larger ecosystem, and its potential as an investment. But beyond these details lies the story of a digital asset that’s weathered market storms, navigated technological shifts, and emerged resiliently time and again.

Yet, as with any venture in the rapidly changing world of cryptocurrency, it’s imperative for individuals to not take anything at face value. Litecoin’s journey provides ample insights, but it is only one chapter in the vast chronicle of cryptocurrency.

To potential investors and cryptocurrency enthusiasts alike: take this exploration as a starting point. Dive deeper, ask questions, and seek multiple perspectives. The cryptocurrency landscape is vast, complex, and ever-evolving. As the saying goes, knowledge is power, and informed decision-making is your most valuable asset.

In closing, whether you view Litecoin as a promising investment, a technological marvel, or simply a fascinating chapter in the annals of digital finance, its story underscores the limitless potential of human innovation. Here’s to the continued evolution of the digital frontier and to each individual’s journey in navigating its vast expanse.